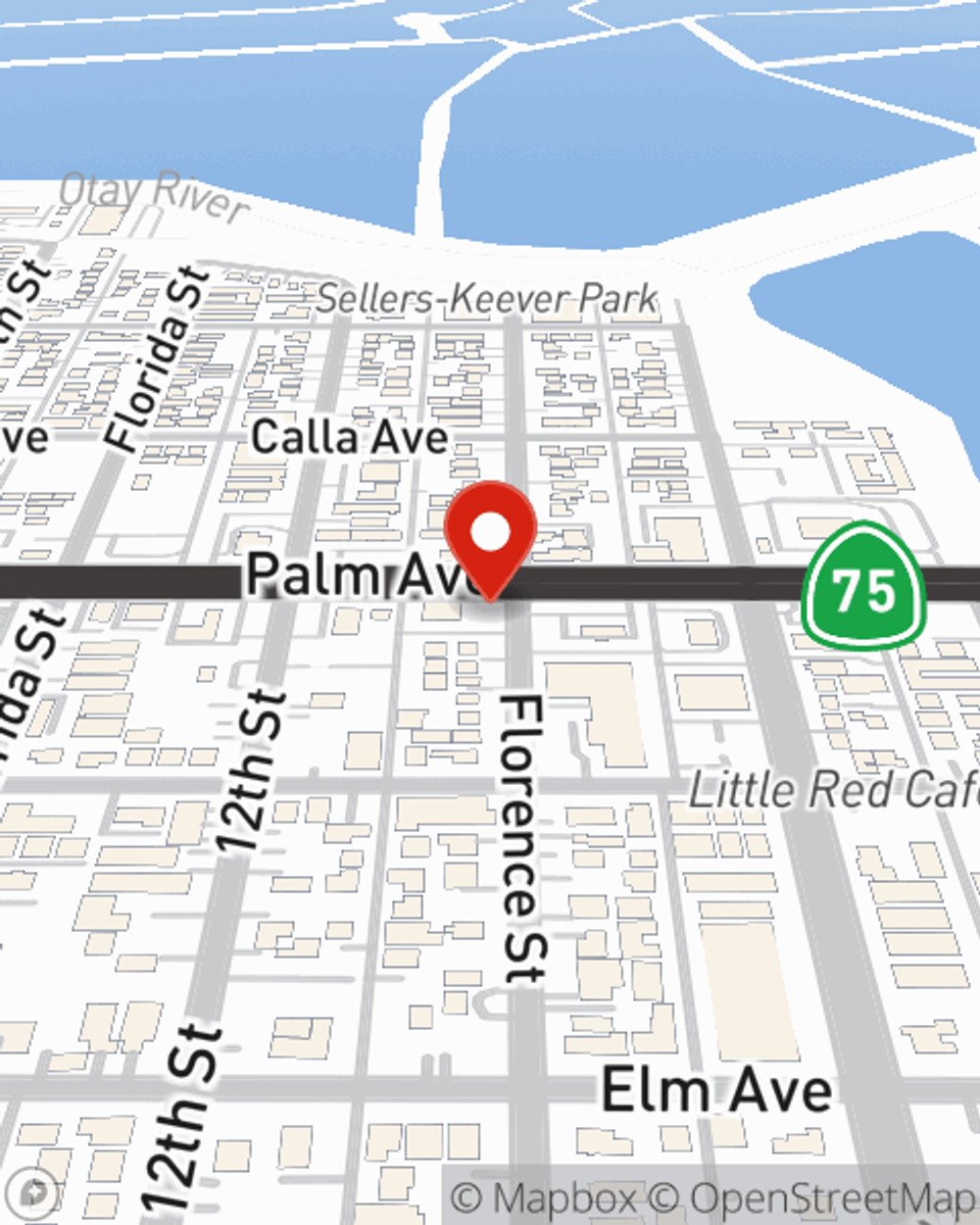

Condo Insurance in and around Imperial Beach

Looking for outstanding condo unitowners insurance in Imperial Beach?

State Farm can help you with condo insurance

There’s No Place Like Home

Because your condo is your home base, there are some key details to consider - neighborhood, location, home layout, and making sure you have the right protection for your home in case of the unexpected. That's where State Farm comes in to offer you quality coverage options to help meet your needs.

Looking for outstanding condo unitowners insurance in Imperial Beach?

State Farm can help you with condo insurance

Agent Tracey Rivera, At Your Service

With this insurance from State Farm, you don't have to be afraid of the unpredictable happening to your biggest asset. Agent Tracey Rivera can help provide all the various options for you to consider, and will assist you in building a wonderful policy that's right for you.

Finding the right protection for your unit is made easy with State Farm. There is no better time than today to call or email agent Tracey Rivera and learn more about your terrific options.

Have More Questions About Condo Unitowners Insurance?

Call Tracey at (619) 424-3956 or visit our FAQ page.

Simple Insights®

Should I pay off my mortgage before I retire?

Should I pay off my mortgage before I retire?

Retiring without mortgage payments could mean less debt and monetary worries in your retirement years. Here are a few tips to help.

How to choose a neighborhood that is right for you

How to choose a neighborhood that is right for you

The trick to choosing a neighborhood to live in is to figure out what matters to you and to do thorough research.

Tracey Rivera

State Farm® Insurance AgentSimple Insights®

Should I pay off my mortgage before I retire?

Should I pay off my mortgage before I retire?

Retiring without mortgage payments could mean less debt and monetary worries in your retirement years. Here are a few tips to help.

How to choose a neighborhood that is right for you

How to choose a neighborhood that is right for you

The trick to choosing a neighborhood to live in is to figure out what matters to you and to do thorough research.